Latest Version

24.3.0

October 03, 2024

Step Mobile, Inc

Finance

Android

0

Free

com.step.step

Report a Problem

More About Step: Bank & Build Credit

Step is a financial technology company that offers a variety of services to help users manage their money and build their credit. With the Step app, users can safely build their credit with every purchase and monitor their credit score. On average, Step users in their 20s see a 57 point increase in their credit score.

One of the main benefits of using Step is the ability to earn cashback on purchases. By using the Step Card, which is accepted everywhere Visa is accepted, users can earn up to 8% cashback on their purchases. This can add up to significant savings over time.

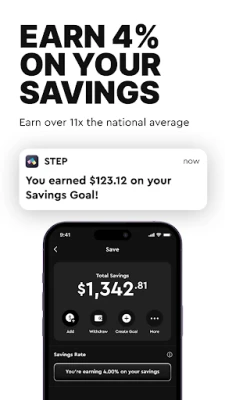

In addition to earning cashback, Step also offers a savings feature. Users can create Savings Goals and automatically add spare change to them through Round Ups. This allows users to earn 4.00% on every penny they save, helping them reach their financial goals faster.

Step also offers the convenience of getting paid early with direct deposit. Users can receive their paychecks up to 2 days earlier than the scheduled payment date. Plus, by setting up direct deposits of $150 or more, users can enter to win monthly prizes such as cash, laptops, and shopping sprees.

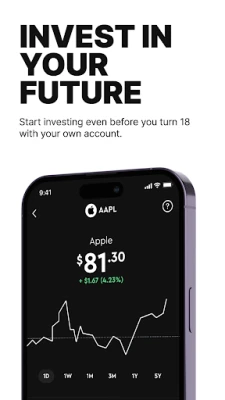

With Step, users can easily move money by instantly sending and receiving money, depositing cash at over 70,000 retail locations nationwide, and accessing over 30,000 fee-free ATMs. Additionally, users can invest with as little as $1 by buying and selling stocks, ETFs, and bitcoin. The Round Ups feature also allows users to turn their spare change into smart investments.

It's important to note that Step is not a bank, but rather a financial technology company. Banking services are provided by Evolve Bank & Trust, a Member FDIC. Step also offers the security of Visa's Zero Liability policy, which protects users from unauthorized transactions. However, this policy may not apply to certain commercial card and anonymous prepaid card transactions. Out-of-network ATM withdrawal fees may also apply.

Rate the App

User Reviews

Popular Apps

Editor's Choice