Latest Version

14.6.52.1

October 31, 2024

slice - feel easy with money

Finance

Android

0

Free

indwin.c3.shareapp

Report a Problem

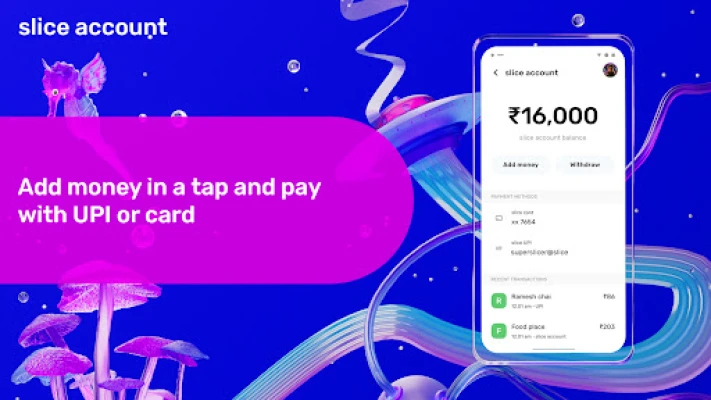

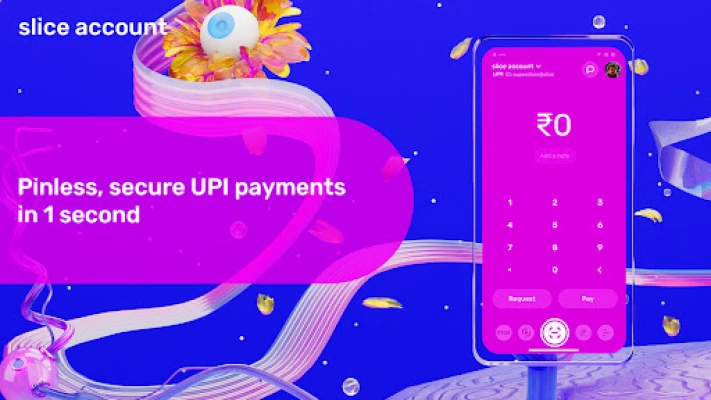

More About slice

Slice is a digital application that allows users to easily manage their everyday payments and expenses. It offers a completely digital onboarding experience, making it simple and fast to sign up. With a slice account, users can enjoy the perks of a premium digital account without any fees. They can easily load money and make payments effortlessly using UPI or a debit card. Plus, they can even go pinless with UPI payments up to ₹5000 and receive instant cashback on their transactions.

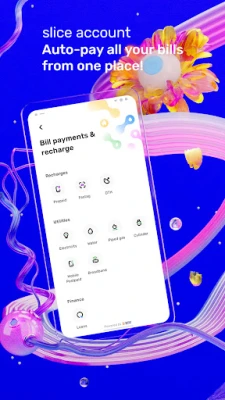

One of the key features of slice is its ability to auto-pay bills and recharges, making it a one-stop-shop for all payment needs. Users can pay for mobile, DTH, Fastag, and utility bills such as electricity, water, LPG, and broadband with ease. They can also manage loan payments and set up auto-pay for all bills, making the process of paying bills a breeze.

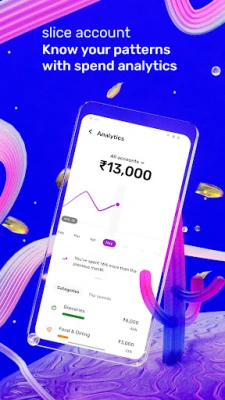

With spend analytics, users can track their spending patterns and gain insights to optimize their expenses. This feature allows them to understand their payment habits and make informed decisions about their finances.

Slice also offers a fast and convenient UPI service, allowing users to make payments in just 2 seconds using a QR code, contact, UPI ID, or bank account. They can also track their spending locations on a map with the geo-tagging feature, making it easier to keep track of their transactions.

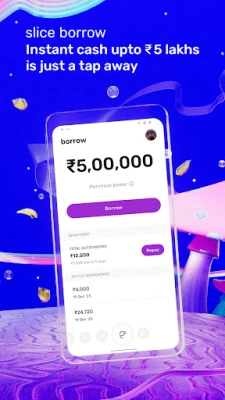

For those in need of instant money, slice offers a borrow feature where users can borrow up to ₹5,00,000 in seconds. The amount is transferred instantly to their bank account, and they can repay it flexibly with a repayment plan designed to help them save on interest. Users can also check their credit score for free in seconds with slice, giving them a better understanding of their financial health.

Overall, slice is a comprehensive and user-friendly application that simplifies the process of managing everyday payments and expenses. With its various features and perks, it aims to make the financial lives of its users easier and more convenient.

Rate the App

User Reviews

Popular Apps

Editor's Choice