Latest Version

5.9.0

October 26, 2024

Self Financial, Inc.

Finance

Android

0

Free

com.selflender.thor

Report a Problem

More About Self - Credit Builder

The Self credit app is a tool that helps individuals build their credit score. It is available to anyone, regardless of their current credit score or lack thereof. The app offers various features to help users improve their credit, such as reporting rent payments to all three credit bureaus, tracking credit score, and offering a credit builder account.

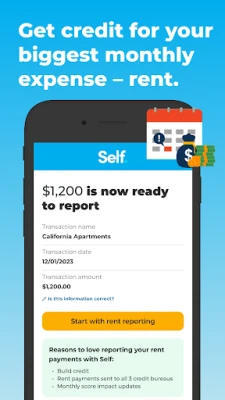

One of the main features of the Self credit app is the ability to report rent payments to the three major credit bureaus at no cost. This can help increase a user's credit score, as positive payment history is a key factor in determining creditworthiness. The app also offers credit monitoring and identity theft insurance for added security.

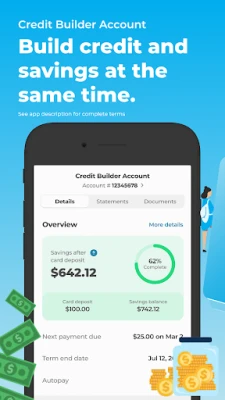

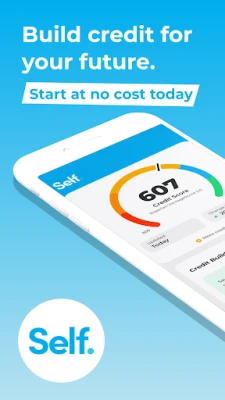

The credit builder account is another important feature of the app. This account allows users to save money while also building their credit. By making on-time payments, users can see an average increase of 49 points in their credit score. The account also offers flexible payment plans starting at $25 per month and does not require a credit check.

In addition to the credit builder account, the app also offers a secured Self Visa® Credit Card. This card is available to users who have an active credit builder account and meet other eligibility criteria. It allows users to control their credit limit and build credit with all three credit bureaus. The card can be used anywhere Visa is accepted in the US.

The Self credit app also offers the option to report other payments, such as cell phone, water, electricity, and gas bills, for an additional fee. This can help users build credit even further by adding more positive payment history to their credit report.

In summary, the Self credit app is a comprehensive tool for individuals looking to improve their credit score. It offers various features such as rent payment reporting, credit monitoring, a credit builder account, and a secured credit card. With no credit check required and flexible payment options, the app is accessible to all credit scores.

Rate the App

User Reviews

Popular Apps

Editor's Choice