Latest Version

7.15.0

November 04, 2024

Current

Finance

Android

0

Free

com.current.app

Report a Problem

More About Current: The Future of Banking

Current is a financial technology company that offers a variety of banking services through partnerships with FDIC-insured banks. This means that while your deposits are not insured by the FDIC, they are still protected by pass-through deposit insurance as long as certain conditions are met. This allows you to access a range of financial services without having to open an account with a traditional bank.

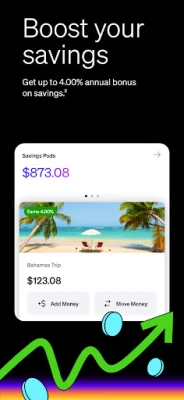

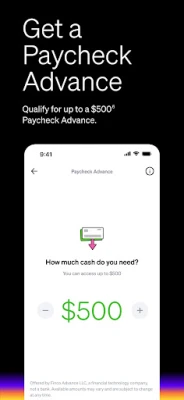

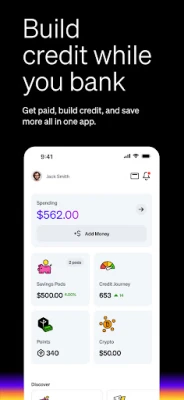

With Current, you can build your credit by using their Build Card, which does not require a credit check. You can also qualify for a $500 Paycheck Advance, skip fees such as overdraft and ATM fees, and get paid up to 2 days faster with direct deposit. Additionally, you can earn up to 4.00% annual bonus on your savings and get rewarded with points and cash back on your purchases.

Current also offers 24/7 support through their app, making it easy to get help whenever you need it. However, it's important to note that some fees may still apply, such as out of network ATM fees, late payment fees, and foreign transaction fees. These fees are outlined in detail in the app's terms and conditions.

It's also worth mentioning that the Current Visa® Debit Card is issued by Choice Financial Group and can be used anywhere Visa debit cards are accepted. The Current Visa® secured charge card, on the other hand, is issued by Cross River Bank and can be used anywhere Visa credit cards are accepted. To apply for the secured charge card, you must have a Current Individual Account and go through an independent approval process.

Overall, Current offers a convenient and accessible way to manage your finances, with the added benefit of potential credit building and rewards. Just be sure to carefully review the terms and conditions and understand the fees associated with the services before signing up.

Rate the App

User Reviews

Popular Apps

Editor's Choice